Background Overview

🎯 Recent Developments

(7 June 2020 – 7 July 2020)

- Petrol and Diesel prices remained unchanged in the metros on Monday, a week of no change following three weeks of daily hikes

- Starting from June 7, fuel prices went up for a consecutive of 22 days.

- The prices of Petrol and Diesel have gone up cumulatively by Rs 9.13 and Rs 11.1 respectively since June 7, in Delhi

- The Top 12 cities are now paying Rs 80 or more for a Litre of petrol

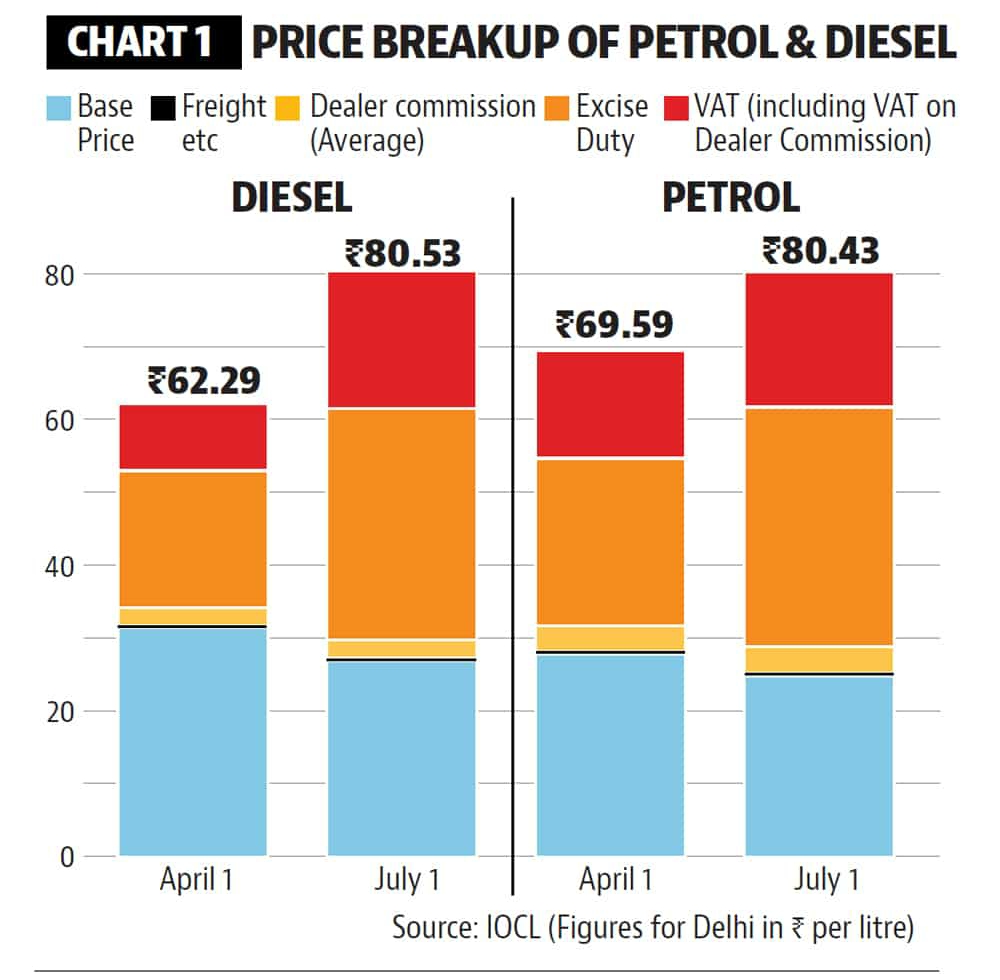

- Indians pay over 250% collectively in excise duty to state and centre

- India has the highest tax rates on fuel as compared to any other country in the entire world

- The base price of petrol is at Rs 18 while over Rs 50-per-Litre are levied on top of it in the form of taxes

- Central taxes per Litre are almost twice of the State taxes

As of today, nearly two-thirds of the Petrol and Diesel price paid by the consumers are taxes. In the case of Petrol, the total tax is 64 percent followed by 63 percent for Diesel.

In absolute terms, tax amounts to over Rs 50 for a Litre of Petrol and Rs 50-55 for a Litre of Diesel. In both cases, around 60% per cent of taxes go to the Centre as excise duty and the rest to states as VAT.

This continuous rise in the Fuel Prices are the result of hiked excise duty by Central Government on Petrol and Diesel by Rs 3 per Litre (each) on March 14 and then again on May 5 by a record Rs 10 per Litre in case of petrol and Rs 13 for Diesel. The two hikes gave the government Rs 2 lakh crore in additional tax revenues. Also, a rise in value-added tax (VAT) by some state governments and union territories during the past months further resulted in aggravated prices of Fuel.

What are the effects of the Fuel Price Hike on the other Sectors?

- Record high prices for Diesel means that the cost of transporting goods goes up across the country. In turn, prices of essential commodities like fruits and vegetables as well as other goods increases.

- Fuel hike leads to an increase in transportation tariffs.

- The increase in fuel price also impacts Electricity sector as it leads to an increase in production costs for generating electricity.

- Manufacturing in Chemical sector, where Petrol is an important component, is also affected.

- The fuel price hike has an impact on each economic sector, by increasing the cost of production and thus leads to national inflation. Inflation rises in line with the rise in fuel prices.

With the above mentioned figures, the motive behind the fuel hike is crystal clear, that is, both the Central Government and State Government is burdening the common people to generate additional revenues. But, Is burdening the Common people only way to generate revenue? Are there no other alternatives available?

To understand other viable options, we first need to understand that Why The Government of India did not follow the trend of decreasing fuel prices as observed in the other nations? Why did it keep on maintaining economic pressure on it’s citizens, when a disaster like COVID-19 has already narrowed down the chances of one’s survival?

Answer to this question can be understood from the following points:-

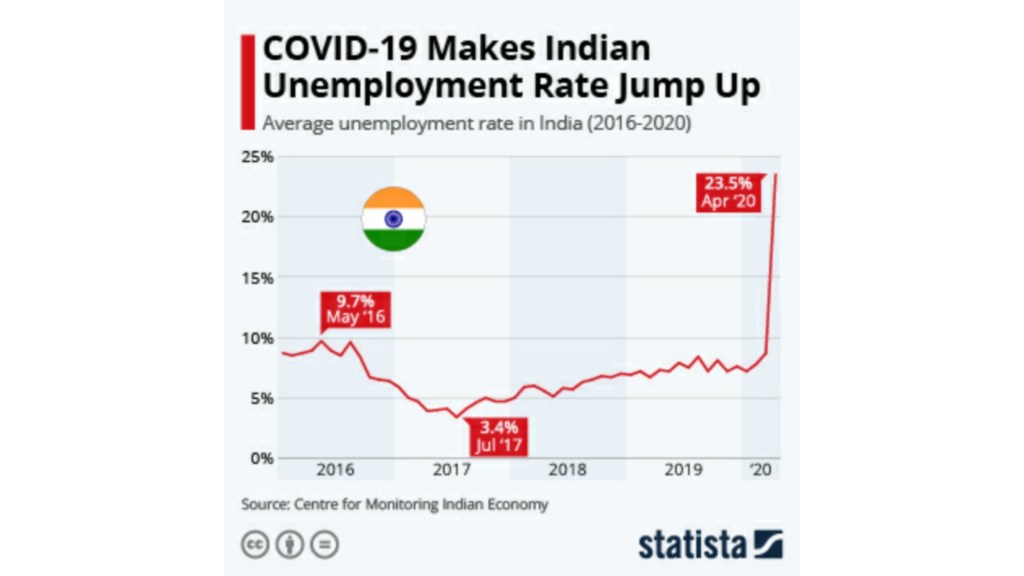

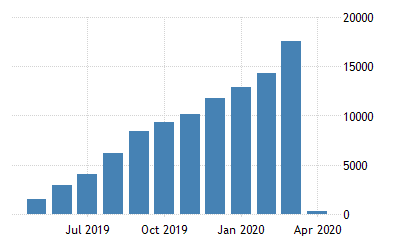

- Firstly, in the course of duration of the COVID-19, the revenue of the Indian Government decreased to 275.48 INR Billion in April from 17507.27 INR Billion in the March of 2020.

- Secondly, with COVID-19 affecting every Sector of the economy, the Formal Sectors (Tax Paying Services) are changing to the Informal Sectors.

- Increase in non-filing of returns has also been observed (the “Lock Down Effect”).

- Depreciation in the value of the Indian Rupee currency (INR).

Thus, both the Central and the State Government, did not fail to spot any opportunity to generate additional revenue – whether it be from an increase in the taxes levied on Fuel (or Booze).

This bring back us to the same question- Is burdening the Common people the only way to generate revenue? Are there really no other viable alternatives in these tough times?

The answer to this question is a BIG NOOOOOOOOO.

There are several other ways with which revenue can be generated by the Indian Government, without squeezing every penny from the Common Mans pocket. Here, a few of them have been enlisted :-

• Taxing the Wealthy💲

The Government needs to raise additional revenue, but that should be done in ways that must not burden the already distressed common man. In view of several European economists, taxing the wealthy would be the most “progressive fiscal tool”, as wealth is far more concentrated than income and consumption. According to a survey conducted by Oxfam, 58% of India’s total wealth is concentrated within 1% of its population.

This super rich segment of the population can be taxed through two alternative means, both of which can be imposed for a limited / fixed period of time –

Raising highest slab rate to 40% for total income levels above a min. threshold of Rs. 1 cr.

Or

Re-introduction of the Wealth Tax for those with net wealth of Rs. 5 crores or more.

The revenue gain associated with both of these options should be worked out to figure out which of them is better in terms of cost-benefit analysis, as implementation rate of both the schemes differ. But it is well known everywhere that the rich has more obligation for the country as around 75% of the GDP is controlled by only 10% of the population.

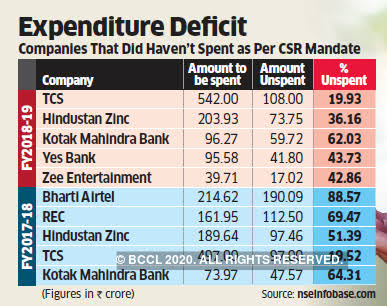

• Mobilization of CSR Funds for COVID relief.

The tax incentives for CSR should be extended at the time of this National disaster. Those companies who are undertaking the COVID relief activities under CSR should be allowed to claim as expenditure incurred for the purpose of business deduction section 37 for Financial Year 2020-21 only. This incentive helps in mobilizing CSR funds for the disaster management.

As per the current law, specified class of companies are required to spend 2 per cent of their average net profits as CSR, failing which the Board has to incorporate the reasons for such failure in its report. The Government can propose to provide a one-time opportunity to the companies to contribute a portion of their unspent CSR funds till FY 2019-20 to COVID Relief Fund.

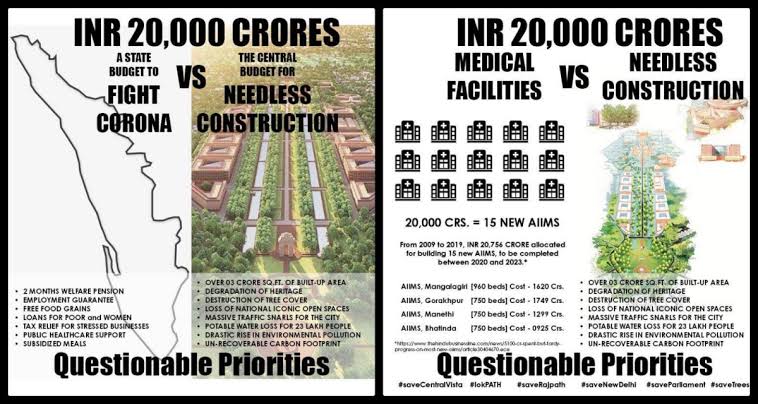

• Postponing Central Vista Project

The Redevelopment Project of Central Vista – the nation’s power corridor envisages a triangular Parliament building next to the existing one, a common Central Secretariat and revamping of the 3-km-long Rajpath — from Rashtrapati Bhavan to India Gate. This project is estimated to cost Government a fortune of Rs. 15,000 Crores to Rs. 20,000 Crores. The Indian Government should consider to delay spending for this purpose and use it for developing Health Infrastructure, or for other much more important projects. A Rs. 20,000-Crore redevelopment plan should be last on the Government’s priority list as the entire nation is reeling under the coronavirus crisis.

Delaying of the project for 2-3 years would not affect the Parliament gravely, as it has been doing just fine till the present times.

• Halting Infrastructure Expenditures

In Financial Year Budget 19-20, the Government of India announced allocation of Rs 94,071 crore to the Ministry of Railways for Infrastructure Development. There is a need to re-orient the expenditure budget as presented in February, 2020. Amidst of COVID-19, The Government can look into cutting these budgets and investing more towards the Health Sector, thereby making it the Power Sector for the Indian Economy, which in the future can result in much greater revenues. Government should invest as much as it can in health sector and make it the driving force of the Indian Economy.

The Government also announced to invest Rs 10,000,000 crores ( US$ 1.5 trillion ) in infrastructure over the next five years. Such Infrastructure development should be delayed for at least a year or two so that the overburden on the Common Man due to taxes and inflation can be lifted.

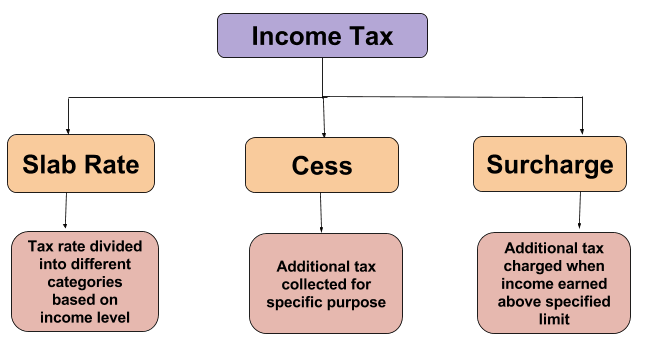

• Increasing International Taxation

The Government can increase the surcharge applicable to the Higher income Foreign Companies having a Branch Office/ Permanent Establishment in India. The said surcharge has not been revised for quite some time.

Foreign Companies are taxed at a rate of 40%. Added to the tax amount is:

- Surcharge on tax:

- 2% in cases where annual income is between Rs. 1 Crore to Rs. 10 Crore

- 5% in cases where annual income is more than Rs. 10 Crore

The Government can increase the surcharge for Foreign establishment earning more than 10 Crore as cess for COVID-19.

Note: Domestic companies are paying more Surcharge (as for now) than the Foreign Companies.

• Rationalization of Equalization Levy

“Equalization Levy”, also known as “Google Tax”, was introduced by the Finance Act, 2016 on certain non-resident businesses on certain “specified services”, largely those providing advertisement space and services. The revenues are taxed at 6% on gross basis. Finance Bill, 2020 proposes to expand the scope of the “equalization levy” to include consideration received by e-commerce operators from e-commerce supply or services, and taxed at a rate of 2%. The Corona economy is largely a digital/online / e-commerce economy. The consumption of online services, especially web streaming services such as Netflix, Amazon Prime, Zoom, etc. and the increased dependence on online commerce has made this sector flourish. The increased business of these e-commerce/ online streaming/ web service companies provides an opportunity to increase the said tax rates by 1%, i.e. from 6% to 7% for ad services, and from 2% to 3% for e-commerce.

• Reintroduction of the ‘ Inheritance Tax ‘

Inheritance tax is levied mostly in developed countries, at rates as high as 55%. In India, it was levied till 1985, payable on a slab basis which ranged from 10% to 85%. Earlier, procedural issues, information asymmetry and implementation problems lead to the tax being abolished. However, in today’s digital age, information is easily accessible, and with the improvements in administrative framework over the last few decades, such a tax is enforceable and implementable now. Inheritance tax, if reintroduced, is expected to reduce concentration of wealth, widen the tax base and enhance revenue, and play its part in bridging the wealth inequality. The richest 10% of Indians own 77.4% of the country’s wealth. The bottom 60%, which is the majority of the population, owns 4.7%. The richest 1% own 51.5%. There is a huge gap between the rich and the poor, and Inheritance tax can bring equality in distribution of income and wealth. More importantly, such tax may eventually lead to reduction in tax rates.

However, it is important to note that reintroduction should be carefully thought through with fair exemptions or limits and only under specified circumstances.

References

https://www.google.com/amp/s/www.charteredclub.com/surcharge-on-income-tax/amp/